Mondi, a global leader in sustainable packaging and paper, shares its fourth annual consumer trend survey, which offers a deep dive into online shopping behaviour and consumers’ attitudes to packaging.

The survey, conducted by RetailX, is the most in-depth study to date, with 1,000 consumers each in France, Germany, Poland, Sweden and Turkey. For the first time it also includes an analysis of generational differences in online shopping patterns.

Mondi Group eCommerce Director, Nedim Nisic says that “We want to be at the forefront of understanding what consumers want when they are shopping online, and what they expect from the packaging protecting their purchases. This research has revealed five macro trends shaping the growing eCommerce packaging market, providing useful insights as we partner with leading retailers to co-create the most sustainable packaging solutions for their needs”.

With three-quarters of customers in the five markets shopping online at least once a month and spending an average of €12 to €120 a month, knowing why they choose to shop online is important, as is understanding the eCommerce features they value the most. Fashion is the strongest product segment, followed by homeware, consumer electronics and beauty products. The survey confirms that across generations and countries, the top drivers for online shopping are lower prices and convenience, specifically saving time and direct delivery to homes.

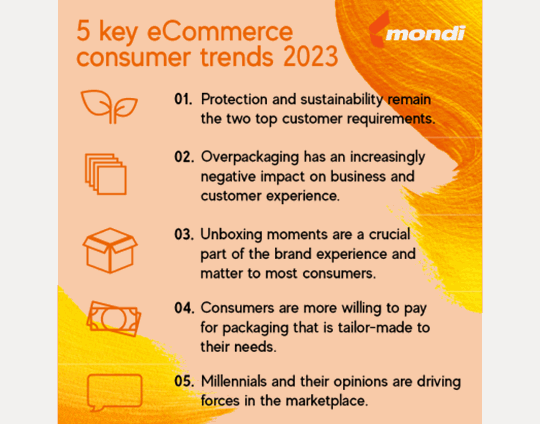

The five key trends are outlined below.

Trend #1: Protection of goods and environmental considerations continue to be two of the strongest customer requirements

94% of consumers cite protection of goods as their most important factor, especially when it is a product of value. This is followed by ease of closing for returns, which has increased from 74% in 2019 to 88% this year. “As customers have seen the growing availability of easy-close packaging, so they have also realised how well it fits their needs, both in terms of the convenience of being able to easily reseal without hunting for the packing tape but also the sustainability aspect of reusing packaging,” says Nisic. Packaging being environmentally friendly (84%) and easy to dispose of (80%) were the next most important factors.

Trend #2: Overpackaging is costing more than expected

Oversized packaging annoys 86% of consumers, up from 79% in 2021, and excess internal packaging annoys 78% of customers. In fact, more than two-thirds (67%) of respondents across the five countries said that overpackaging would put customers off buying from the brand. “Overpackaging is not sustainable or cost-effective. The research now also shows that it can influence buying decisions, with customers choosing not to support retailers that get it wrong.” says Nisic.

Trend #3: The unboxing moment matters

Packaging is not just about functionality; it is about the total experience. This survey found that awareness of ‘unboxing’ is rising in many markets. In Poland, for example, in 2019, 32% of consumers had heard of ‘unboxing’, compared to 66% this year. In 2021, 46% of those surveyed said that a unique unboxing experience inspired by standout product packaging due to packaging would convince them to order from the same retailer again. This year, that has risen to 78%. “The concept of unboxing is more than just a customer unwrapping their order,” says Nisic. “It’s about using the opportunity to give customers a brand experience they will remember for all the right reasons.”

Trend #4: Consumers are increasingly willing to pay a small premium for packaging that meets their needs

Consumers say they are increasingly willing to pay around €1 extra for packaging that best suits their needs. Willingness to pay for best-fit packaging rose from 48% in Poland in 2021 to 81% this year and from 56% in 2021 in Germany to 70% in 2022. Overall in the five markets, 72% of consumers are willing to pay for packaging, with Generation Z (80%) and Millennials (74%) being the most likely to agree.

Trend #5: The behaviour and trends of Millennials are driving the market

These are customers who are shopping online with the greatest frequency and are the most likely to be buying online at least once a day (8%) and more than once a week (37%). They are also spending heavily across sectors. Their views are also some of the strongest, with Millennials the most likely to rate the various packaging characteristics as being crucial to them when compared to other generations. They are also the generation with the greatest willingness to pay extra for packaging that suits their needs.